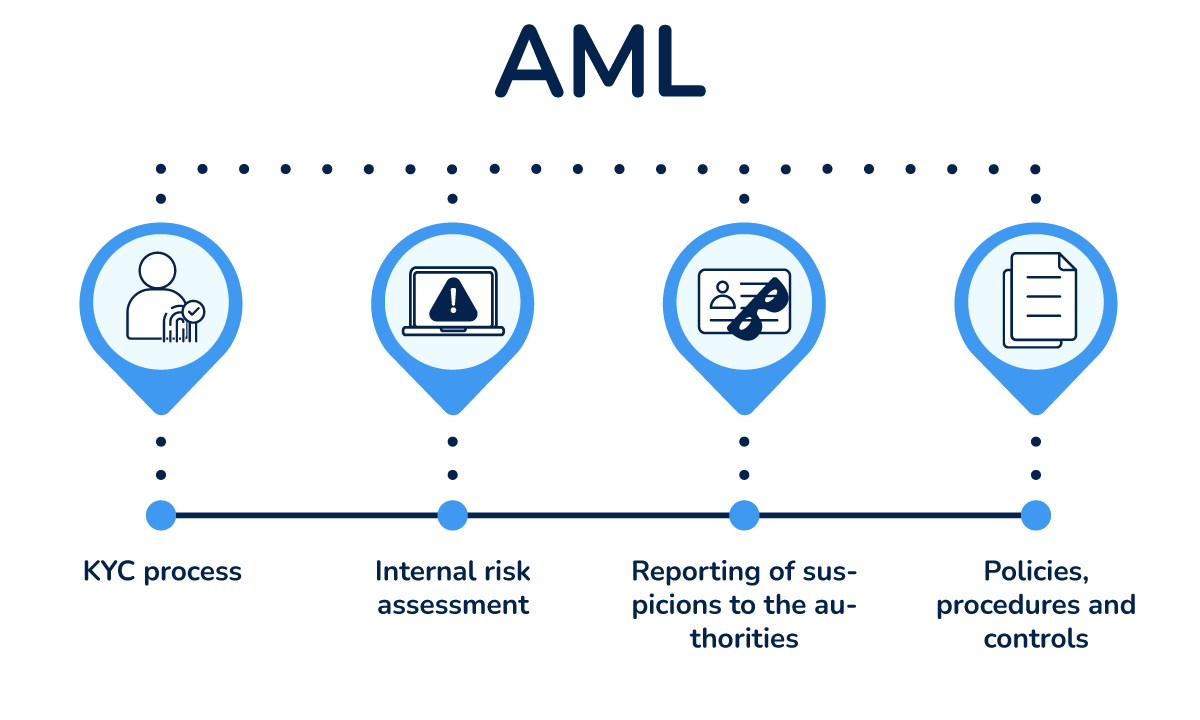

The AML procedure is aimed at combating money laundering on a global scale and the financing of terrorist organizations. Our team takes all necessary measures to ensure security during the exchange of digital assets. We do not allow individuals and legal entities to the platform without preliminary and multi-level verification. Only people with an impeccable business reputation perform exchange transactions here on a daily basis.

To reduce the possibility of fraud to zero, sellers and buyers perform identity verification procedures. The site administration requires users to send:

1. A photo of an open passport.

2. Government-issued identity card.

3. Utility bill or bank statement. Documents must be issued within the last 3 months, paper or electronic versions are acceptable.

4. Driver’s license.

5. Photo of a credit card.

6. Photo of a printed handwritten declaration.

The last document listed is required when users perform transactions with large amounts. Additionally, you will need to take and then send a selfie with your ID and credit card. Only high-quality and legible documents will be accepted for consideration. You will not be able to confirm your identity if you send blurry photos with blurry text. It is strictly forbidden to make changes to the documents or deliberately distort reliable information. In this case, the request will be guaranteed to be rejected, and the administration will ask you to repeat the procedure. You will have to send the previously listed documents again to gain access to all the functions of the site. The administration is loyal to people who accidentally made a mistake or did not carefully read the rules during registration. You can always report a problem and quickly find a way to solve it. Only criminals and people involved in money laundering should be afraid.

AML verification is a complex procedure and preventive measure. During identification of the person, documents issued by state authorities are used. The administration trusts only information received from reliable sources. The previously listed documents are difficult to forge and adjust to mislead. Signatures, numbers with a certain sequence of numbers, photographs and seals do not allow hiding the identity. In addition, information about the owner of the credit card is stored in open databases of tax authorities.

During a multi-stage check, experts try to find the full name in the consolidated “black list” of the European Union. Officials in Brussels regularly impose sanctions on individuals and legal entities for various violations. Our company is prohibited from any form of cooperation with businessmen who are included in the “black lists”. We work only with responsible and law-abiding citizens. You will not be able to carry out transactions with valuable assets if you provide false or incomplete information. An attempt to hide updated data is considered a gross violation of the rules and is punishable by immediate blocking of the account. If signs of fraud are detected, company representatives terminate cooperation and then contact law enforcement agencies. The perpetrators receive a well-deserved punishment taking into account the severity of the crime committed.

Our team does not limit itself to one-time checks. All clients are under 24/7 surveillance to detect possible violations. Non-standard transactions with valuable assets attract attention. The owners of the Crypto Swap website have the right to stop transactions at any stage if a hidden threat is detected. Further verification is carried out taking into account the recommendations of the international organization FATF.

Information about completed transactions with digital assets is archived. Law enforcement agencies can only access the database after an official request or a court decision.

Our team can organize an extended check at any time using international methods. During the procedure, risks are assessed and the activity of a suspicious client is analyzed. At the slightest danger, suspicious transactions are blocked and digital assets are frozen. Persons who are related to mafia syndicates, terrorist organizations and money laundering are prohibited from being present here. Crypto Swap does not contact businessmen previously convicted of economic crimes. Clients are required to report the source of their income. If they earn money in any illegal way, business relations are terminated.

Accounts of violators are deleted by the Crypto Swap website administration for attempts to impersonate another person. We are obliged to report the actions of intruders to the competent authorities. If signs of fraud are detected, our employees pass on names, email addresses and other contact information of people to the police.

When a person is unable to demonstrate the source of their income, they may fall under suspicion. They will be pursued for a long time by law enforcement agencies, who will seek to block bank accounts and seize property. An attempt to mislead the site administration may result in a court verdict.

Experienced criminals always find unconventional ways to bypass restrictions, so Crypto Swap periodically updates the electronic system to increase the level of security. Constant and high-quality work allows honest customers not to worry during transactions with digital currencies. In the event of the emergence of new methods of combating intruders, the management always organizes training for staff with the invitation of experts. Every year, methods of counteracting persons who try to launder money are improved.

How Crypto Swap Contributes to the Fight Against Terrorism and Crime

During a comprehensive check, we receive a large amount of information. The task is greatly simplified by European, American and other databases listing known criminals. Monthly government reports and international sanctions lists are useful. The administration selects a suitable verification method and then asks to demonstrate a package of documents. We reserve the right to request additional information at any time. All completed transactions are carefully analyzed to identify possible manipulations.

Customers are notified that they have violated local laws or international regulations before their account is verified. The duration of the procedure depends on the specifics of the individual case. If minor deficiencies are detected, customers are given time to update their information. If they categorically refuse to comply with the requirements, the account is blocked without the right to restore. The administration writes a statement to the place of residence of the person who was involved in the manipulation. Cheating and falsifying information during verification may lead to proceedings and imprisonment.

Only law-abiding citizens have no reason to worry. They quickly register and perform transactions with digital assets 24/7. If questions or difficulties arise, qualified consultants come to the rescue.

What obligations do all Crypto Swap clients undertake?

1. Before using the Crypto Swap website, I confirm that I am not a high-ranking official or a prominent figure in my country. I do not have close relatives who have a significant influence on political processes. This is a mandatory condition. Close relatives include brothers, sisters, grandparents, nephews and persons with whom you permanently cohabit.

2. I confirm that I am the owner (beneficiary) of a company or the owner of valuable assets.

3. When performing transactions, I will act only on my own behalf. I do not intend to represent the interests of businessmen or groups of people. If the situation changes, I will definitely send a written notice to the manager by e-mail info@anvi-group.com as soon as possible.

4. I undertake to use the Super Exchanger service only for legal purposes. I have nothing to do with cybercrime, real estate fraud, organizing illegal migration, distributing child pornography, drug trafficking, endangered exotic animals, weapons and ammunition. My activities are not aimed at supporting religious radicals, smugglers, neo-Nazis, pedophiles, hackers and various antisocial elements.

The owners of the service remind customers of the need to study the provisions of local legislation before starting work. For example, regulatory authorities can severely punish a businessman for organizing gambling entertainment without a license. If slots and roulettes are prohibited by law in your country, we will not allow the owner of a gambling establishment to use the Crypto Swap service.

All future clients are required to confirm that they do not engage in the production of obscene adult films or videos that promote violence, call for war, insult people on racial grounds, or incite hatred among various social groups and religious denominations.